Ever wanted or needed to buy or sell cryptocoins on a whim, without going online?

Ever felt like cashing in 100,000 Satoshis or so at 3am to treat your party buddies to a kebab-fest on the way home from a big night out?

Well, if you live in the UK, you can’t easily do any of those things any more.

Last Friday, the UK’s FCA, short for Financial Conduct Authority, published an official bulletin entitled: Warning on illegal crypto ATMs operating in the UK.

You might think that would leave a bunch of legal ATMs online, but the FCA says that there are, in fact, no correctly registered cryptocurrency ATMs anywhere in the country, and thus that they must all shut down at once, or else:

Crypto ATMs offering cryptoasset exchange services in the UK must be registered with [the FCA] and comply with UK Money Laundering Regulations (MLR). None of the cryptoasset firms registered with us have been approved to offer crypto ATM services, meaning that any of them operating in the UK are doing so illegally and consumers should not be using them.

“Unregulated and high-risk”

It’s not clear whether the primary concern of the FCA is specifially that unscrupulous operators could make it easy for criminals to cash out significant cryptocurrency payments untraceably.

After all, if you’re buying or selling cryptocoins via an existing payment card account or mobile phone payment system, from an ATM in a shopping centre, you’d think that the operation would be at least as trackable as any transaction involving a non-cryptocurrency account, such as a big-money purchase in a department store or luxury brand shop.

The FCA does, however, seem concerned that these devices could make it easier for vulnerable individuals to get suckered into cryptocurrency scams, by lowering the barrier of entry to acquiring cryptocoins in the first place:

We are concerned about crypto ATM machines operating in the UK and will therefore be contacting the operators instructing that the machines be shut down or face further action.

Since we published the list of unregistered crypto firms that may have been continuing to conduct business, a recent assessment found that 110 are no longer operational.

We regularly warn consumers that cryptoassets are unregulated and high-risk which means people are very unlikely to have any protection if things go wrong, so people should be prepared to lose all their money if they choose to invest in them.

Whereas online cryptocoin exchanges can demand some sort of document-based signup process, such as requiring new purchasers to upload scans of personal identification first (we’re not going to discuss the pros and cons of that approach here, merely to mention it), it’s hard to see how a cryptocoin ATM conveniently placed in a local shopping centre could usefully conduct much of a “know your customer” process up front.

The cryptocoin ATM could snap a photo of you in front of the machine, of course, and no doubt does so for its own sake anyway, but rules are rules, and regulations are regulations, and whatever hoops a registered ATM operator in the UK needs to jump through to ensure they are licensed correctly…

…it seems that no one has yet jumped those hoops correctly.

According to the BBC, there were fewer than 100 cryptcoin ATMs operating in Britain last week anyway, but we’re guessing that the number is zero now.

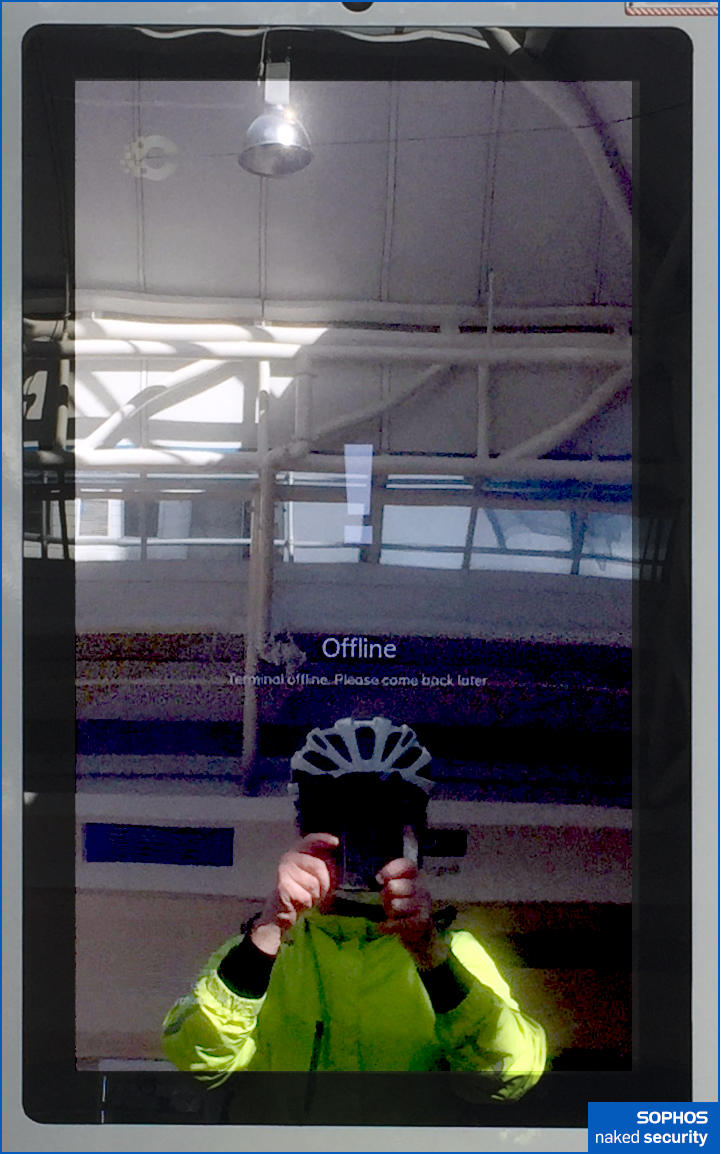

Here’s the closest device to Sophos HQ that we’re aware of (we made a quick trip to check its status during our lunch break); you can see that this one is still powered up, but dutifully spurning customers:

Andy

Frankly cryptocoin should be ruled illegal worldwide! It serves no truly needed purpose, its environmental footprint is horrendous, it mostly benefits the underworld, financial profiteers and delights self-pleasing cybergeeks! As long as humanity keeps busying itself with unneeded, frivolous and wasteful endeavours there is no hope for a better world!

John

While Andy makes a point with which I agree whole heartedly, I have claimed to all my friends that Crypto, especially Bitcoin is a geek game. Nothing more. The object of the game is to keep going until someone, human or machine gets the last one and is declared the winner. We know the rules and we know the design for Bitcoin, maybe not for others, is a limited number of “coins”. The limit is pretty large and we may never get there. The value of a Bitcoin is what somebody will pay another for the privilege of saying “I own one of those”. There are people with real money, that they don’t need, willing to pay for the “ownership” privilege of owning. The wasted resources on this game are horrendous. With the present technology, there won’t be enough wind turbines or solar panels or nuclear power stations to generate the electricity needed to finish the game or to make enough machines. The incremental power and, therefore, cost to get to the last Bitcoin is similar to the incremental power and cost needed to power an airplane for the last kilometre per hour to achieve the speed of light. To me it is the 21st century version of “how many angels can sit on the tip of a needle” or how many electrons in the universe. That’s my opinion for what it’s worth. I suspect It’s worth much much less than one Bitcoin.

Paul Ducklin

Remember that mining Bitcoins doesn’t depend on there being any Bitcoins left to acquire “from new”. So even when the “new BTC” reward for mining a block is down to next to nothing, miners will still receive transaction fees. The purpose of putting an asymptotic cap on the total number of BTC that can ever exist was simply that the Bitcoin ecosystem was the first cryptocurrency ever tried, so the designer decided to put a hard and immutable limit on the total money supply. Other cryptocoins use different approaches, such as locking onto a steady increase in the total supply after some time, “premining” all the coins and distibuting them in some way, or some combination of these.

Who knows how it will turn out in the end? No one tried any of this before BTC came along, so no one claiming to be an expert can say they’ve got any previous experience :-)

The cryptocoin scene certainly smells of tulips *to me*, but as many observers have pointed out, tulips still make a large contribution to the Dutch economy, even if the market isn’t as wild as it once was, and by some accounts, the so-called “great tulip bubble burstage” of 1637 was no more dramatic or destructive to the economy at large than, say, the dot-com bubble of this millennium.

Andy

“The cryptocoin scene certainly smells of tulips *to me*, but as many observers have pointed out, tulips still make a large contribution to the Dutch economy…” Who’s economy does cryptocoin benefit?

Paul Ducklin

Well, I wasn’t trying to answer that question, merely pointing out that the Dutch economic system didn’t vanish with the “tulip bubble” that was part of it (nor did the business of tulip cultivation vanish). On that basis, you might argue that the Bitcoin economy won’t inevitably vanish when the supply of new “coinbase-minted” Bticoins is exhausted, and the cryptocoin economy (and I am not entirely sure what I mean by that, but you probably get my drift :-) won’t inevitably vanish at the same time.

I was not intending to adddress the issue of “who benefits?” here, merely to examine the presumption that “it must inevitably implode because of the exponential deflation thing”.

If you *know* the answer, surely you could guarantee returns for yourself, shorting or hodling according as you consider the implosion inevitable or not?

Andy

To quote from Study.com: “An economy is a system of organizations and institutions that either facilitate or play a role in the production and distribution of goods and services in a society. Economies determine how resources are distributed among members of a society; they determine the value of goods or services; and they even determine what sorts of things can be traded or bartered for those services and goods.”

Based on the above or similar definitions, there is no such thing as “cryptocoin economy”, it serves no useful purpose to society, resources management & distribution; it’s a sterile, self-serving & wasteful exercise!

Paul Ducklin

The definition you provide simply describes an economy as “a system for making and distributing certain things in which they are seen to have some negotiable value”. It doesn’t address the issues of relevance, righteousness, resource usage and so on. So condemning cryptocurrency because “it is not an economy” seems to be a semantically unnecessary part of your argument that paradoxically undermines it. You could replace your statement above with the words from “it serves” to the end and make the same point more directly. (A better, or at least more practical, definition of “is it part of the economy or not” might simply be “does the tax office or the financial regulator have an interest in it”.)

Kyle

“cost to get to the last Bitcoin is similar to the incremental power and cost needed to power an airplane for the last kilometre per hour to achieve the speed of light” – there is so much wrong with this sentence. If we started harvesting energy from every atom in the entire universe when it came into existence 14 billion years ago, continued to harvest that energy for another trillion years, and managed to store all that, and then suddenly released all of it into an engine 1km/h away from the speed of light, that *still* would not be enough energy to propel the craft to light speed. By contrast, the last Bitcoin will inevitably mined within the next 200 years at most.

Paul Ducklin

I think that the OP intended it as a *metaphor*, not as an actual comparison :-)

(I wonder what percentage of the BTC global supply will have beem lost or otherwise become unspendable by then? How many Bitcoins will be left to rattle around inside the ecosystem, swapped from owner to owner as payments or transaction fees?)

Anna

Interesting post, thanks for sharing.