Cybersecurity, cyber insurance, and ransomware are closely connected, with both security and insurance providers focused on reducing the business impact of ransomware, one of the biggest threats facing organizations today.

To understand the reality of this three-way relationship in 2023, Sophos has conducted new research into cyber insurance adoption, the role of cyber defenses in securing a policy, and how insurance coverage impacts response to ransomware incidents.

Our survey of 3,000 cybersecurity/IT professionals conducted in January and February 2023 across 14 countries reveals that:

- 91% of organizations have some form of cyber insurance coverage, with standalone policies slightly more popular than including cyber in a broader business policy

- Cyber insurance adoption increases with revenue, with the highest revenue organizations reporting the highest propensity to have cyber coverage

- 95% of organizations with cyber coverage say that the quality of their cyber defenses directly impacted their insurance position, including their ability to get a policy, the cost of their coverage, and the terms of their policy

- Paying the ransom considerably increases the role of cyber defenses in being able to securing cyber coverage – but likely not on the cost of the policy

- Organizations with cyber insurance are better able to recover data after a ransomware incident, with almost all ransomware victims that have insurance getting their data back

- Organizations with standalone cyber insurance policies and that had data encrypted in a ransomware attack are almost four times more likely to pay the ransom to recover their data than those without cyber coverage

Click here to read the report.

Cyber Insurance Adoption 2023

The research has revealed that cyber insurance is now the norm. Independent of geography, industry or revenue, the vast majority of organizations have some form of cyber coverage:

- 47% have a cyber standalone policy

- 43% have cyber insurance as part of a wider business policy

- 8% don’t currently have cyber insurance but plan to get coverage in the next year

Note, with rounding, total coverage is 91%

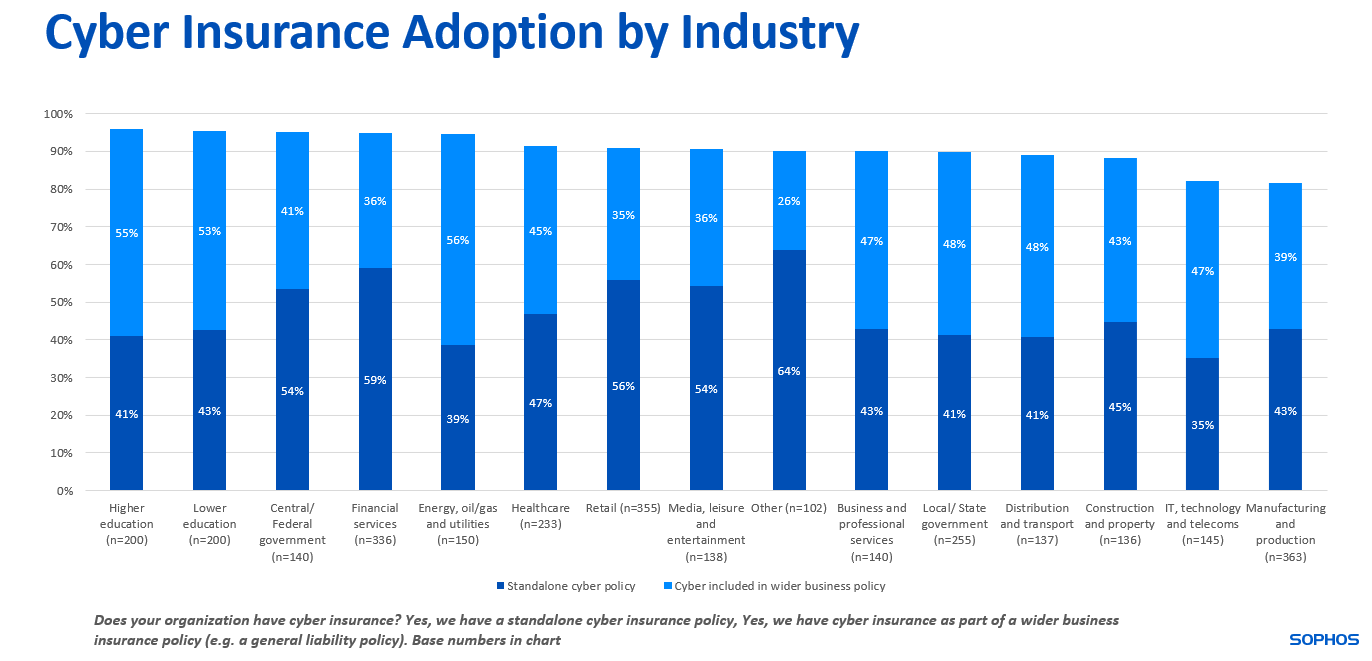

Cyber Insurance Adoption by Industry

At an industry level, education (both higher and lower) reported the highest overall level of cyber insurance coverage (96%) although they are more likely to have cyber as part of a wider business insurance policy than to have a standalone policy. Financial services is the sector most likely to have a standalone cyber policy (59%), closely followed by retail (56%). Conversely, IT, telecoms, technology is the least likely (35%) with energy, oil/gas, and utilities close behind on 39%.

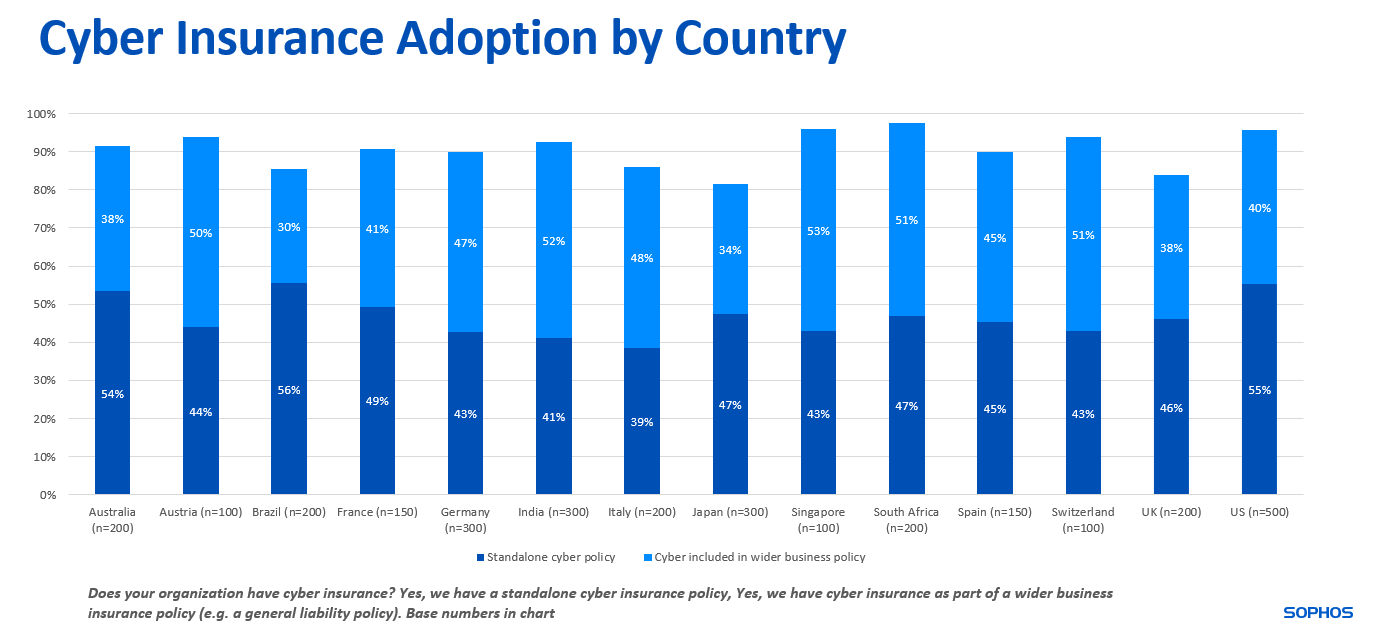

Cyber Insurance Adoption by Country

South Africa reports the highest overall rate of coverage of the 14 countries surveyed (98%), while Brazil (56%) and the United States (55%) have the highest levels of standalone policy adoption. The lowest level of coverage was reported in Japan (82%) although still more than four in five organizations have some form of cyber insurance. Italy reported the lowest level of standalone policy take-up (39%).

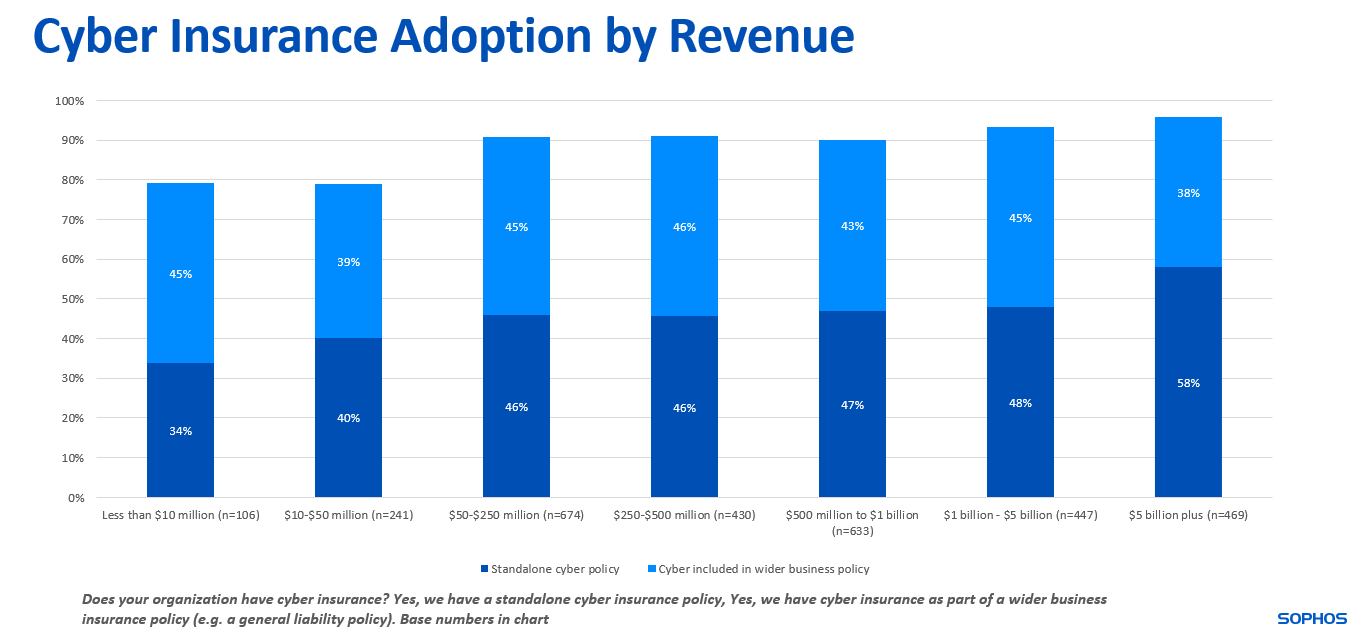

Cyber Insurance Adoption by Revenue

Perhaps unsurprisingly, cyber insurance adoption increases with revenue. 96% of organizations with $5 billion + annual turnover have some form of cyber coverage compared with 79% of those reporting revenue of less than $50 million. Higher revenue organizations also have a greater propensity to have a standalone cyber policy than lower revenue ones: 58% of organizations reporting an annual revenue of over $5 billion have a standalone policy compared with 34% of those reporting annual revenue of less than $10 million. Overall, the study reveals a steady increase in standalone policy adoption with revenue.

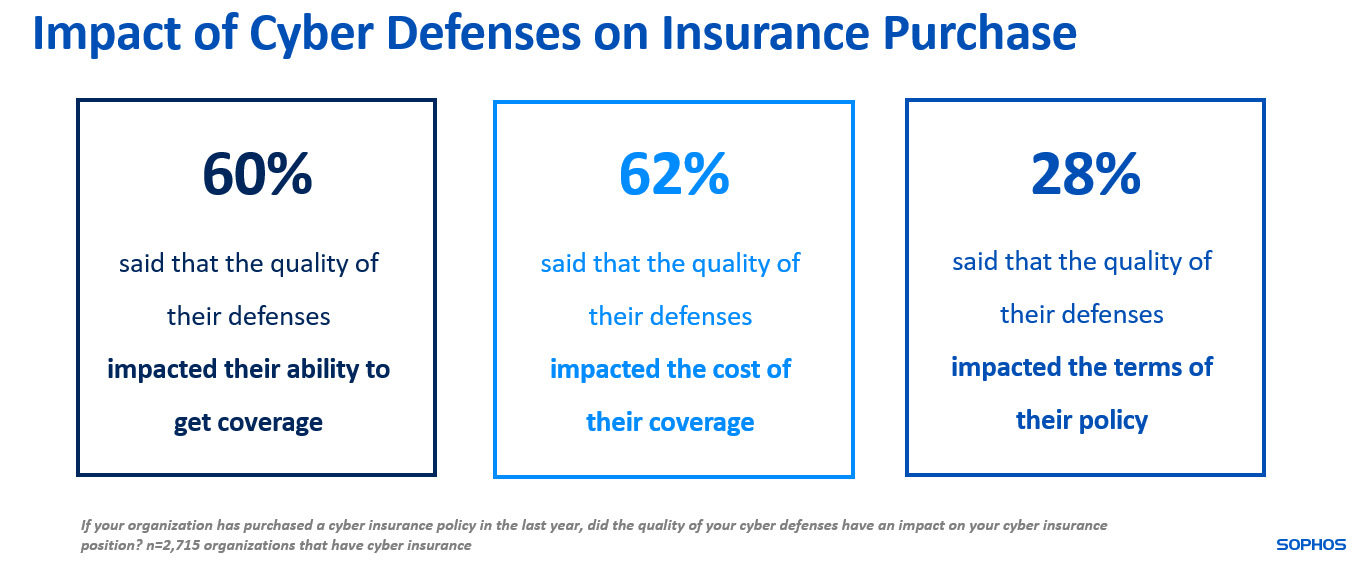

Impact of Cyber Defenses on Cyber Insurance Purchase

Quality of cyber defenses is a major factor in the ability of organizations to secure cyber insurance coverage, with 95% of those that purchased a policy in the last year saying the quality of their defenses impacted their cyber insurance position. 60% said that the quality of their defenses impacted their ability to get coverage, while 62% said it impacted the cost of their policy and 28% reported that their defenses impacted the terms of their policy e.g., total amount of coverage, sub-limits etc.

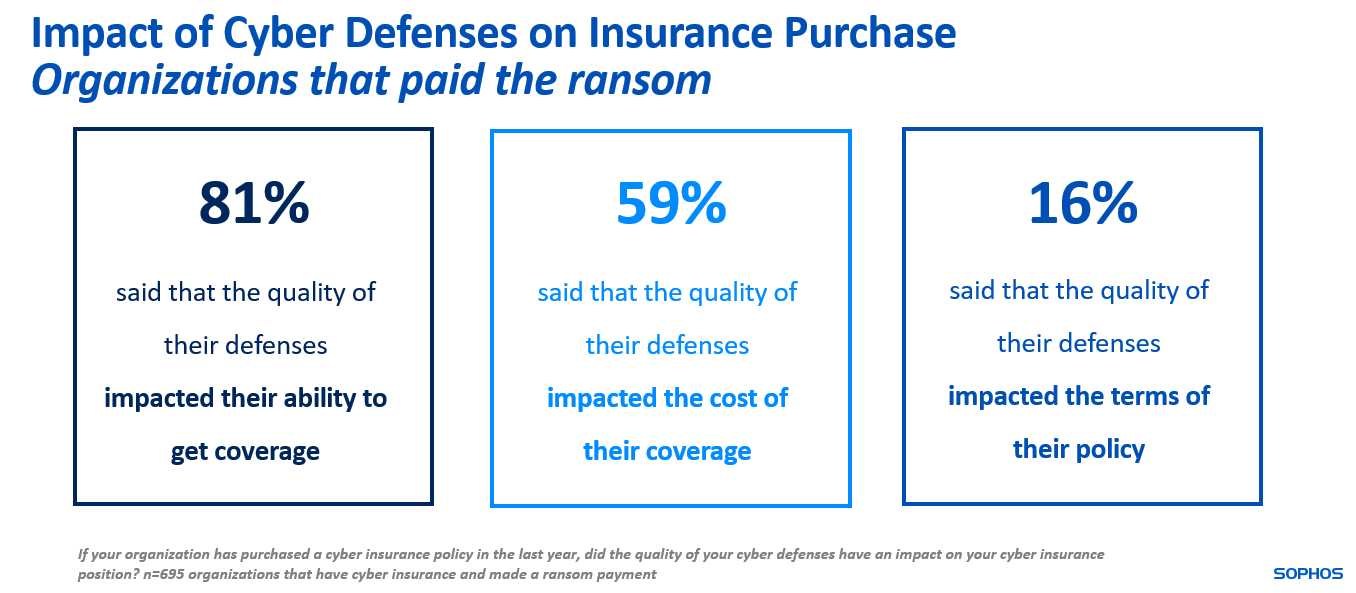

Impact of Ransom Payment on the Role of Cyber Defenses in Securing Coverage

Paying the ransom has a considerable impact on the role of cyber defenses in securing a policy – but seemingly not on the cost of the policy. 81% of those that were hit by ransomware in the previous year and paid the ransom reported that the quality of their defenses impacted their ability to get coverage, a 35% increase over the average. However, 59% of those who paid the ransom reported that the quality of their defenses impacted the cost, in line with the global average of 62%. Overall, 99% of those that paid a ransom said their cyber defenses impacted their insurance position in some way.

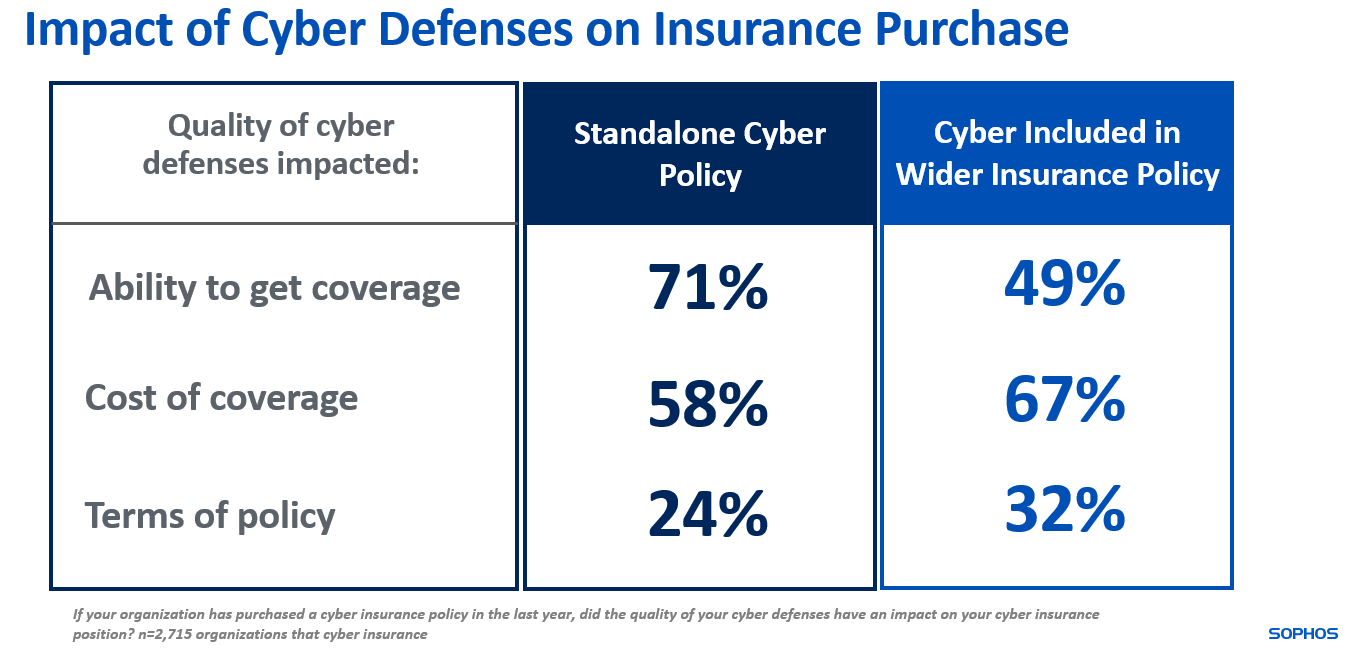

Standalone Policy vs. Wider Business Policy

The role of cyber defenses in securing coverage is much greater for standalone cyber policy purchases than when cyber is included in a wider insurance policy. 71% of those with a standalone policy said that the quality of their defenses impacted their ability to get coverage, compared with 49% of those with a more general policy. Conversely, the quality of cyber defenses is more likely to impact the cost of the policy for those that include cyber in a wider business policy than for those with standalone coverage (67% vs. 58%).

Cyber Insurance and Ransomware

Encrypted Data Recovery

Organizations with cyber insurance are more likely to be able to recover data following a ransomware incident than those without coverage. The study revealed very little difference in data recovery between those with a standalone policy and those with a wider business policy, with almost everyone with some form of cyber coverage getting some data back. Conversely, only 84% of organizations without cyber coverage reported that they could recover data.

For all three groups, backups were the most common method used to recover data, followed by paying the ransom. One fifth (21%) of organizations reported using multiple methods to recover their data. Factors that may drive the increased ability of organizations with cyber insurance to recover data include:

- Assistance from the insurer in the data recovery process

- The strong cyber controls required to secure a policy put organizations in a better position to recover data e.g., secure backups, incident response plan

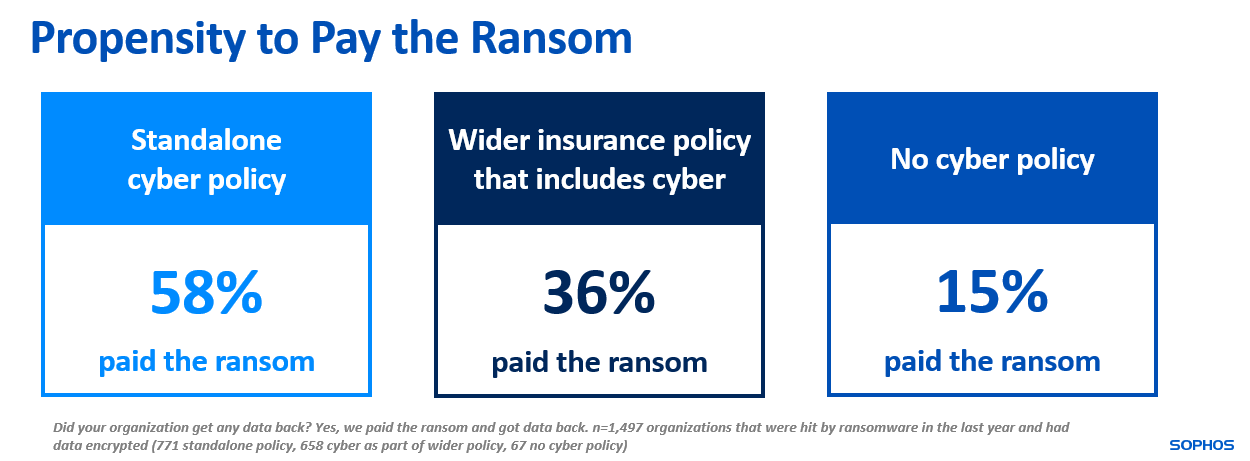

Propensity to Pay the Ransom

The study also revealed that ransomware victims with standalone cyber insurance policies are almost four times more likely to pay the ransom to recover encrypted data than those without cyber coverage. 58% of organizations with a standalone cyber insurance policy and had data encrypted in a ransomware attack last year paid the ransom to get their data back. In comparison, 36% of those with cyber as part of a broader insurance policy paid the ransom and 15% of those without cyber insurance.

Optimize your Cyber Defenses with Sophos

The research has highlighted the importance of the quality of cyber defenses for the purchase of cyber insurance. Sophos’ award-winning managed detection and response (MDR) and incident response services, and endpoint detection and response (EDR), extended detection and response (XDR), network, email, and cloud security technologies enable organizations to optimize their protection and their insurance position.

Sophos services and products to protect more than 500,000 organizations from active adversaries, ransomware, phishing, malware, and more, and Sophos is the world’s most trusted MDR service, securing more than 15,000 customers with 24/7 human-led threat detection and response.

Testament to the quality of our defenses, Sophos has been named a Leader in the Gartner Magic Quadrant for Endpoint Protection Platforms for 13 consecutive reports and is AAA rated by SE Labs with a 100% protection score. Customers give Sophos top ratings on Gartner Peer Insights and G2 alike, and Sophos is also the only provider named a Leader for MDR, XDR, EDR, Endpoint Protection, and Network Firewalls in G2’s Spring 2023 Reports.

To discuss your cybersecurity requirements and how Sophos can help you elevate your defenses, speak to one of our security advisers or start a no-obligation free trial.

About the Survey

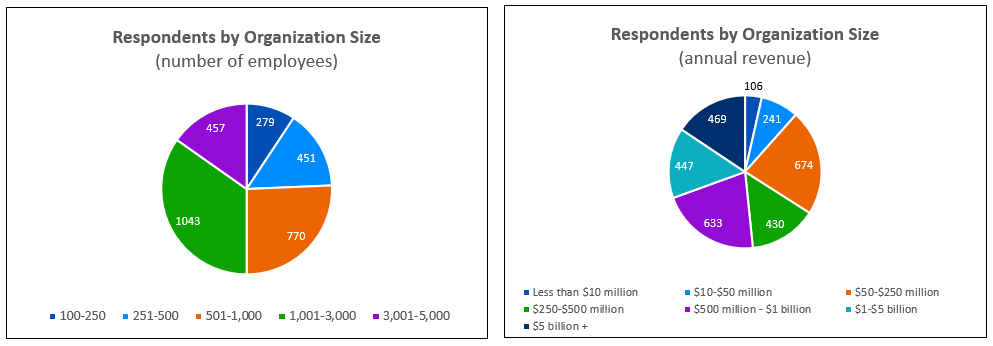

Sophos commissioned an independent survey of 3,000 leaders responsible for IT/cybersecurity across 14 countries. All respondents were from organizations with between 100 and 5,000 employees (50% 100-1,000 employees, 50% 1,001-5,000 employees). The research was conducted between January and March 2023 and reflects organizations’ experiences of ransomware and cyber insurance in the previous 12 months.

Respondents per country:

- Australia 200

- Austria 100

- Brazil 200

- France 150

- Germany 300

- India 300

- Italy 200

- Japan 300

- Singapore 100

- South Africa 200 Spain 150

- Switzerland 100

- United Kingdom 200

- United States 500

Please note that Sophos is not a licensed insurance producer and does not sell, solicit or negotiate insurance products. By providing access to any third-party websites, Sophos is not recommending or endorsing any such third parties, or any products or services offered by such third parties. To the extent you access a third-party website from a Sophos website, please be advised that Sophos does not investigate, monitor, or check any third-party websites, or the content of such websites, for accuracy, appropriateness, or completeness, and you are solely responsible for your interactions with such third parties.